The Chief Commissioner’s office consists of two Joint Commissioners, two Assistant Commissioners and supporting staff. They assist in monitoring revenue collection, recovery of arrears, disposal of pendencies, redressal of the grievances and complaints of the trade/public. Co-ordination among the Commissionerates within the Zone and effective interaction with the Trade to facilitate the import and export operations are also matters handled by the Chief Commissioner’s Office. It also keeps the Central Board of Excise and Customs posted of the progress in GST revenue collection and other Customs related work achieved by the Zone through periodic statements and reports. The Assistant Commissioner in Chief Commissioner’s Office is designated as CPIO to handle requests under the RTI Act.

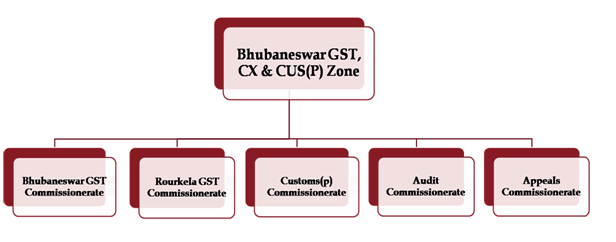

Chief Commissioner is a member of a committee that reviews the adjudication orders passed by the Commissioners in the Zone for their legality and propriety. He also supervises the functioning of the Commissioners of two GST Commissionerates – i)Bhubaneswar & ii) Rourkela, Customs Preventive Commissionerate, Commissioner (Appeals) and Commissioner of Audit Commissionerate, Bhubaneswar. The Chief Commissioner reports directly to the Central Board of Excise and Customs, Ministry of Finance, New Delhi.

BRIEF PROFILE OF THE JURISDICTION OF GST, CENTRAL EXCISE & CUSTOMS, BHUBANESWAR ZONE

| GST, Central Excise & Customs, Bhubaneswar Zone, with HQ at Bhubaneswar, comprises of 2 nos. of GST Executive Commissionerate, 1 no. of Customs (Preventive) Commissionerate, 1 no. of Audit Commissionerate & 1 no. of office of

Commissioner (Appeals). |

| Bhubaneswar GST & Central Excise Commissionerate:- The Commissionerate HQ is situated at Bhubaneswar. The geographical jurisdiction of the Commissionerate includes the Districts of Khurda, Cuttack, Kendrapara, Jagatsinghpur, Puri, Jajpur, Bhadrak, Balasore, Dhenkanal, Nayagarh, Ganjam, Rayagada, Gajapati, Koraput, Malkangiri, Nabarangpur, Kandhamal and Kalanhandi of the the State of Odisha. It comprises of 8 nos. of Divisions and 55 nos. of Ranges. The name of the Divisions are, Bhubaneswar-I, Bhubaneswar-II, Cuttack-I, Cuttack-II, Jajpur, Balasore,

Berhampur & Rayagada. |

| Rourkela GST & Central Excise Commissionerate:– The Commissionerate HQ is situated at Rourkela. The geographical jurisdiction of the Commissionerate includes the Districts of Angul, Sundergarh, Sambalpur, Deogarh, Jharsuguda, Subarnapur (Sonepur), Boudh, Bargarh, Balangir, Keonjhar, Mayurbhanj & Nuapada of the State of Odisha. It comprises 7 nos. of Divisions and 40 nos. of Ranges. The name of the Divisions are, Rourkela-I, Rourkela-II, Sambalpur-I, Sambalpur-II, Jharsuguda, Angul

& Keonjhar. |

| Customs (Preventive) Commissionerate, Bhubaneswar:- The Commissionerate HQ is situated at Bhubaneswar. The geographical jurisdiction of the Commissionerate includes the whole of Odisha State. It comprises of 5 nos. of Divisions, namely, Bhubaneswar Customs Division, Paradeep Customs Division, Gopalpur Customs Division, Dhamra Customs Division & Jajpur Road Customs Division. Biju Patnaik Internation Airport at Bhubaneswar, Paradeep Port, Gopalpur Port, Dhamra Port & ICD Kalinganagar, Jajpur are also under this Commissionerate. Recently a Foreign

Post Office branch has been opened at Bhubaneswar. |

| Audit Commissionerate:- The Commissionerate HQ is situated at Bhubaneswar. It looks after the audit work of both Bhubaneswar and Rourkela, GST & Central Excise Commissionerates coming under this Zone. It comprises 7 nos. of Audit Circles, namely, Bhubaneswar Audit Circle, Cuttack Audit Circle, Jajpur Audit Circle, Berhampur Audit Circle, Rourkela Audit Circle, Sambalpur Audit Circle & Angul Audit Circle. It comprises of 19 nos. of Audit groups. |

| Commissioner (Appeals) :- The HQ of the Appeal Commissinerate is situated at

Bhubaneswar. It handles all appeal matters in respect of GST, Central Excise, Service Tax & Customs under Bhubaneswar Zone. |